The first instance exhibits how Fibonacci retracements can be used to determine multiple levels of help that can indicator tools for trading help predict the sawtooth sample of an general bullish movement. It is important to use additional indicators, particularly MACD, to determine when support or resistance is definitely being encountered and a reversal is likely. The extra that additional indicators are pointing in the path of a reversal, the extra doubtless one is to happen.

Fibonacci Retracement Ranges As Trading Technique

Therefore, it might be considerably easier to identify and anticipate help and resistance ranges from Fibonacci sequences. Use a retracement grid to analyze pullbacks, reversals, corrections, and other price actions throughout the ranges of primary uptrends and downtrends. Use an extension grid to measure how far uptrends or downtrends are more doubtless to carry beyond a breakout or breakdown stage. This analysis forms the basis for establishing technical value targets and profitable exit zones. Fibonacci retracement ranges are horizontal traces that indicate the potential assist and resistance levels the place value may potentially reverse course.

Tips On How To Use The Fibonacci Extension

Shallow retracements happen, but catching these requires a closer watch and a quicker set off finger. The focus might be on average retracements (38.2-50%) and golden retracements (61.8%). In addition, these examples will show tips on how to combine retracements with different indicators to verify a reversal.

What Are The Widespread Retracement Levels?

It additionally identifies key reversal zones and slim value bands where trending markets should lose momentum and shift into trading ranges, topping, or bottoming patterns. For unknown causes, these Fibonacci ratios seem to play a job within the stock market, simply as they do in nature. Technical traders attempt to use them to find out crucial points the place an asset’s price momentum is prone to reverse.

The Method To Use Fibonacci Levels In Trading? Significance Of Fibonacci Ranges

Fibonacci buying and selling instruments, however, tend to suffer from the identical issues as other common trading strategies, such as the Elliott Wave concept. Fibonacci Retracement is a powerful device used in foreign foreign money trading to identify potential price reversals. Based on the Fibonacci sequence, it entails drawing ranges at key points where the worth would possibly reverse. Fibonacci retracements could be combined with other indicators such as candlesticks, worth patterns, momentum oscillators, or transferring averages to create a robust buying and selling technique and make sure potential reversals. Fibonacci levels are used so as to establish factors of help and resistance on price charts for financial buying and selling.

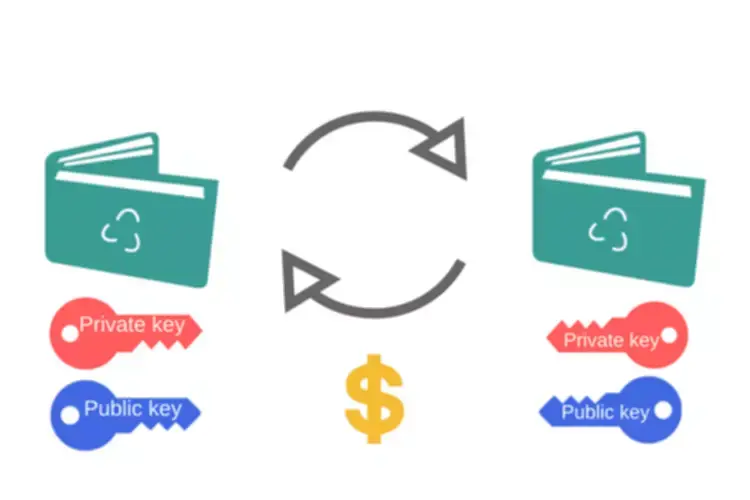

In monetary markets, fluctuation in asset prices is regular and happens as impulses and pullbacks. Based on the direction of value movement, buyers and traders could make earnings or suffer losses. Therefore, they have to rely on technical analysis and use related instruments to their advantage.

If this stock continues to right additional, the dealer can be careful for the 38.2% and 61.8% ranges. It is believed that the Fibonacci ratios, i.e. 61.8%, 38.2%, and 23.6%, finds its utility in stock charts. Fibonacci evaluation may be utilized when there’s a noticeable up-move or down-move in costs. Whenever the inventory strikes either upwards or downwards sharply, it normally tends to retrace again earlier than its subsequent move.

Faqs About Fibonacci Retracements

The greatest brokers for day traders can additional aid investors trying to predict inventory costs by way of Fibonacci retracements. Fibonacci retracements can be used to position entry orders, determine stop-loss ranges, or set worth targets. Since the bounce occurred at a Fibonacci stage throughout an uptrend, the trader decides to buy. The trader may set a stop loss on the 61.8% degree, as a return under that level could indicate that the rally has failed. In buying and selling developments, merchants expect the trend line to kind a resistance in the case of a downtrend, and support, within the case of an uptrend, making the value bounce off the trend line multiple occasions. The data you get from the retracement ranges will assist you to decide potential assist and resistance points, and what you do with such data is determined by your buying and selling strategy.

As the correction approaches these retracements, you must turn into extra alert for a potential bearish reversal. Stock transferring averages may be calculated across a wide range of intervals, making them relevant to both lengthy and short-term investment strategies. When navigating the monetary markets, merchants can select from numerous tried-and-true methods. Fibonacci retracement might help merchants identify shopping for and promoting signals available in the market. When the value approaches a Fibonacci retracement stage, traders could consider coming into or exiting positions based mostly on the anticipated reversal or continuation of the development.

Forex and CFDs are leveraged products that incur a excessive stage of risk and a small adverse market motion could expose the consumer to lose the whole invested capital. The vast majority of retail consumer accounts lose money when buying and selling in CFDs. You should think about whether or not you perceive how CFDs work and whether you can afford to take the high danger of dropping your cash. CFI International Ltd supplies common information that does not bear in mind your aims, financial scenario or needs. Please make certain that you understand the dangers involved and search unbiased recommendation if needed. Technical analysis focuses on market action — specifically, volume and worth.

And to go brief (or sell) on a retracement at a Fibonacci resistance stage when the market is trending DOWN. The concept is to go lengthy (or buy) on a retracement at a Fibonacci help stage when the market is trending UP. In addition to the ratios described above, many merchants additionally like using the 50% level. As an illustration, a stock begins at $10 and soars to $15 before slipping back to $12.5. After the down transfer, the inventory tried to bounce again retracing back to Rs.162, which is the 61.8% Fibonacci retracement stage. Price does not transfer in a straight line; it goes through a sequence of pullbacks, forming one thing like a zig-zag sample.

- Often, it will retrace to a steady Fibonacci retracement stage, similar to 38.2% or sixty one.8%.

- Globally recognised broker with over 25 years’ expertise in monetary trading services.

- Based on earlier market behavior, skilled traders can plot Fibonacci retracements and ratios to uncover potential assist and resistance ranges.

- Identifying Fibonacci Retracement ranges on worth charts is relatively simple once you understand the concept.

- Fibonacci retracement ranges are based mostly on ratios used to identify potential reversal factors on a worth chart.

This helps in planning the trade and using suitable stop losses to mitigate or minimise the danger of huge loss. Similarly the traders also can estimate the revenue levels by wanting on the costs at varied resistances after which take a name on the the way to trade. The retracement ranges are derived from the Fibonacci sequence and are represented as horizontal lines on a worth chart. Among the myriad methods at their disposal, Fibonacci evaluation emerges as a stalwart companion, offering a nuanced understanding of… Fibonacci retracements are used on a wide range of monetary instruments, together with stocks, commodities, and overseas forex exchanges.

Read more about https://www.xcritical.in/ here.