Gonna purchase your earliest house or apartment with a construction financing? Look at this blog post to possess eight professional tips which might be dedicated to first-time home loan consumers.

New RBI enjoys shorter the latest repo price so you can historical downs, making merchandising money such as lenders extremely reasonable. If you’ve been going to purchase your first domestic, this is often an excellent time and energy to turn your own plan for the an actuality.

However, since home financing is a huge-admission mortgage that you’ll repay to have 15-twenty years or even more, it is very important see the basics. If you are looking having home financing order your first real estate, listed below are seven information which will help-

step one. Start with Evaluating Your bank account

Immediately following taking the financing, you’ll end up necessary to pay EMIs every month. Very, beforehand looking at features and you will lenders, it’d getting best if you first very carefully see your finances.

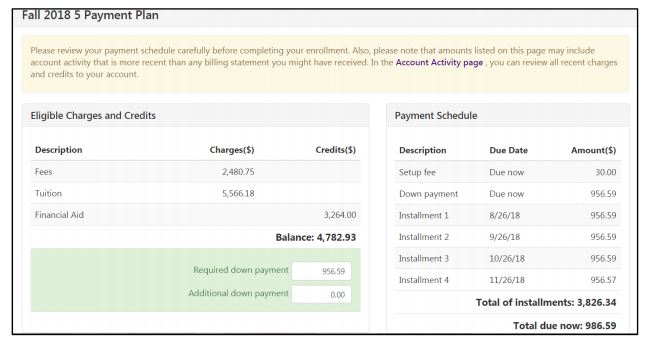

Aside from EMI, you will also need to reason behind the down-payment you will want to make. Really loan providers promote home loans as much as 70%-90% of the property really worth. Other than this, think about costs eg stamp duty, financing handling percentage, etc.

2. Favor a property Very carefully

The new developers otherwise developers that a credibility to how to get a 600 dollar loan quick have postponing otherwise not completing strategies usually are blacklisted because of the lenders. If you are planning purchasing a home for the a job created by the one particular developer, it will be easy that financial may not agree your loan request even although you are eligible to the mortgage.

Furthermore, it is possible having a loan provider not to agree mortgage demands of consumers who wish to get a property during the particular blacklisted urban centers. Choose a house meticulously and make certain that the designer otherwise town isnt on blacklist of your own bank you’ve chosen.

3pare Most readily useful Lenders

Since interest is regarded as the most significant thought when getting a home loan, there are many things instance LTV (Loan-to-Value) ratio, qualifications criteria, payment freedom, documentation process, and customer support that should also be closely analysed when you’re seeking the lending company.

A lender one fulfils such conditions while offering mortgage brokers during the a competitive speed is good solutions. If you’ve ever pulled a loan regarding a particular financial and you will reduced they promptly, you can try a comparable lender for your house loan. Many of the loan providers is actually open to interest rate transactions to possess earlier in the day people.

cuatro. Submit an application for PMAY Subsidy

Under the “Housing for All” initiative, the Government offers home loans at subsidized interest rates to eligible candidates. If this is your first home, and none of your family members own a property in their name anywhere in the country, you might qualify for PMAY (Pradhan Mantri Awas Yojana) subsidy.

The latest subsidy can be acquired for people owned by EWS (Financially Weaker Part), LIG (Low income Classification), MIG We (Middle class Group We), and you may MIG II (Middle-income group Classification II) kinds. Keep in mind that don’t assume all lender inside the Asia is eligible to have providing PMAY subsidies. When you find yourself eligible for that it subsidy, prefer a lender accepted around it design.

5. Prove Their Eligibility

Perhaps one of the most important factors getting a lender will be your own qualification into mortgage. Every lender possess qualification criteria predicated on that it approves and you will denies loan requests. Factors like your earnings, credit score, current fund, and you may decades might possibly be analysed from the financial just before granting the fresh new loan.

Whenever you are an effective salaried otherwise worry about-operating elite group with a constant source of income a lot more than Rs. 25,100 monthly and you can a credit history away from above 700, you should primarily be eligible for home financing away from most lenders. You can check your credit score when you go to the brand new CIBIL site 100% free just after yearly.

6. Imagine a shared Loan

For those who have a functional companion, you can also thought getting a combined home loan. After you put a great co-applicant into the loan application, the likelihood of acceptance improve due to the fact duty of paying the fresh financing would be common from the a couple of those with a steady resource of money. Moreover, some loan providers also offer mortgage brokers at a less costly speed when among the many co-candidates was a female.

Along with, with a mutual mortgage, both co-applicants meet the requirements in order to allege income tax deductions. Loan fees together with becomes easier which have a couple of doing work anybody functioning towards clearing the borrowed funds as fast as possible.

seven. Look at the Mortgage Documents Cautiously

If for example the application for the loan is eligible, the lending company will need one indication certain documents before the amount borrowed was in the end paid. Always very carefully understand all loan data files prior to signing. Concur that the latest conditions and terms, especially the interest, EMI, and you can loan tenure, to the financing data files are identical as the discussed anywhere between you and the mortgage administrator.

Many individuals avoid learning your house financing records, it is a serious action to cease one inaccuracies from the coming. But if if you’re unable to see something into the document, always clarify the same along with your bank before you sign. The greater amount of cautious you are, the greater comfy and you will sufficient could be the entire process.

Providing home financing for your Earliest Domestic Buy

The journey between putting some home purchase choice last but most certainly not least and then make the purchase by using a home loan would be daunting. The help of an established lender renders this course of action fret-totally free and you may small.